New Jersey Pay It Forward Student Bill of Rights

The Student Bill of Rights for the New Jersey Pay It Forward program.

The New Jersey Pay It Forward Program provides zero-interest loans for participants—especially those who may not have the savings to pay for training or the credit history for a loan—to enroll in high-quality job training. Participants receive living stipends and supportive services including access to one-time financial assistance and mental health counseling to help them succeed.

After completing training, if participants earn above a minimum salary (e.g., $51,975 for those with a household of three), they pay back their loan through monthly repayments of 10% of their discretionary income for up to five years. If they don’t earn more than this minimum salary, they pay nothing. Participants also do not have to pay back their living stipends or the cost of wraparound supports.

Student Bill of Rights

1. Right to Support Services

Participants have the right to support services that will help them graduate, find a good job, and achieve increased economic well-being. These include:

- Living Stipend Grant: Participants receive an option to opt-in to cash assistance to help with expenses while in school. They will receive these funds in multiple installments and can elect to receive them via a virtual debit card or a withdrawal to a bank account, Venmo, or PayPal. They are not responsible for repaying these funds. They are advised to consult with a tax expert to understand tax obligations associated with the living stipend grant.

- Additional Support Services: Participants will have access to additional support services at no additional cost, including access to mental health counseling and one-time financial assistance, if needed.

2. Right to Transparency

Participants have the right to see clear, complete, and easy to comprehend terms and costs affiliated with their loans. Accordingly, they will be provided:

- Disclosures Containing Loan Terms: All loan terms and costs are detailed in the Application and Solicitation Disclosure, the Approval Disclosure, and the Final Disclosure in accordance with the Truth in Lending Act (Regulation Z).

3. Right to Open Communication

Participants have the right to have open access to staff throughout the lifecycle of their loans (from pre-application to full repayment) who can answer their questions and care about their success.

- Loan Origination: Loans will be originated by Funding U. They will communicate with participants regarding the status of their loan applications. They will disburse loans to training providers. For questions about the loan application, please contact Funding U at info@funding-u.com or 404-800-1297.

- Loan Servicing: Loans will be serviced by MOHELA. They will communicate with participants regarding all repayment obligations, and participants will be responsible for remitting payments and submitting required documentation to MOHELA. For questions about loan repayment, please contact MOHELA at 888-212-5908.

- Support Services: For general questions about living stipend grants and additional support services, please contact training providers. For questions related to the virtual debit cards and withdrawals, please contact Usio directly by logging into your account and navigating to the “Contact Us” tab or email njpayitforward@socialfinance.org.

4. Right to Student-Centric Financing

Participants have the right to finance their education in a way that is cost-effective and linked to their career success. Therefore, every NJ Pay It Forward loan will have:

- Loan Amount linked to Funding Gap: Participants may apply for a loan at the advertised list price of the educational program, minus any other grants or payments received (if applicable). The list price will be provided to participants by the training provider.

- Maximum Loan Payment Term: The maximum number of months participants will make loan payments is 60 months (5 years) from the end of the grace period. If they repay the full loan amount before 60 months, the repayment obligation will terminate early.

- Payment Cap: Participants will never be charged more than the face value of the loan. No interest fees are charged and they are not responsible for any loan fees.

- If a participant withdraws prior to completing 60% of the training program, the payment cap will be adjusted based upon the portion of the training program completed. For example, if a participant takes out a $10,000 loan and withdraws after 40% of the training program, they will be responsible for maximum repayments of up to $4,000. Their monthly payments will still be based upon income, and their maximum payment term will still be five years. However, if they withdraw after completing 60% of the training program, their payment cap will not be adjusted.

- Downside Protection: Participants will not have a payment due in months in which their income is below the minimum income threshold if they have applied for and been granted a deferment. The minimum income threshold is a dynamic amount equal to $1,000 per month above 150% of the Federal Poverty Level. The 2025 Federal Poverty Level Guidelines can be found here. These thresholds will change as Federal Poverty Levels change.

- Deferments may also be granted for the following reasons: 1) on active military duty; 2) have been affected by a natural disaster; 3) have declared bankruptcy; and 4) experiencing extenuating personal hardship.

- Monthly Payment based on Actual Income: If participants earn above the minimum income threshold, their monthly payment amounts will be 10% of their monthly discretionary income.

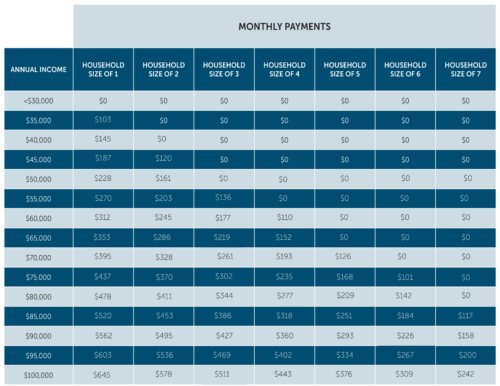

- Discretionary income is the amount earned above and beyond 150% of the Federal Poverty Level based upon household size. As income decreases or increases, monthly payments will fluctuate. The table below shows monthly payment obligations based on household size. Payments will be based on participants’ actual household size.

- Participants are responsible for providing proof of income to the loan servicer. If participants do not provide proof of income, the loan servicer will assume they are earning the median income for the occupation for which they trained, per current Bureau of Labor Statistics data.

- Grace Period: Participants are not required to make any payments while in school or during the three-month grace period. The grace period begins on the 1st day of the month following the date of successful exit (i.e., the date of graduation or job placement, whichever date occurs first), withdrawal, or dismissal from the training program. For example, if participants successfully exit, withdraw, or are dismissed from the training program on January 10, 2023:

- the grace period will begin on February 1, 2023;

- the grace period will end on April 30, 2023;

- the loan payment term will begin on May 1, 2023;

- the payment will be based on the participants’ income from April 2023;

- and the first payment will be due by May 26, 2023.