Workforce & Education Investments, Workforce & Economic Mobility, Financing Workforce & Talent Innovators

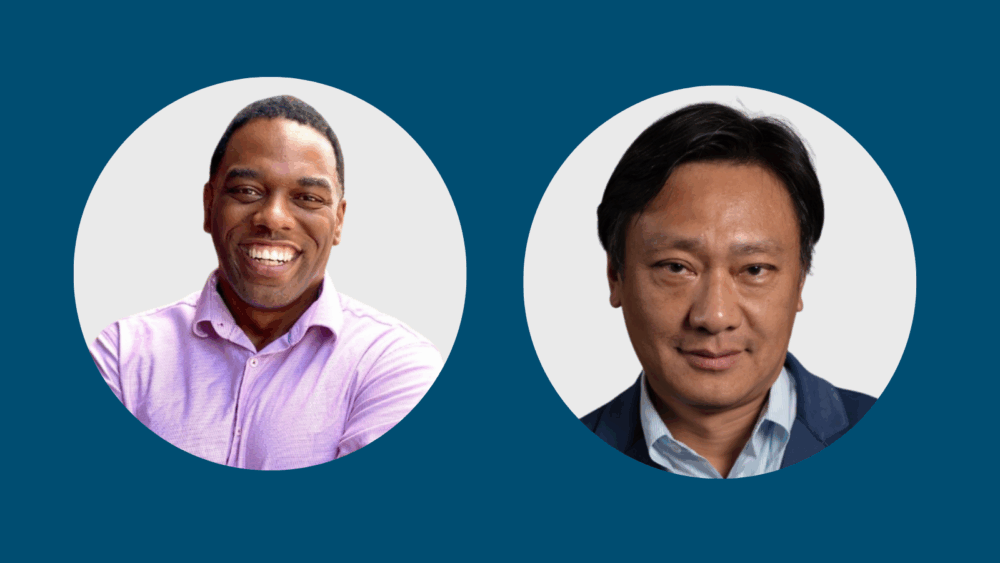

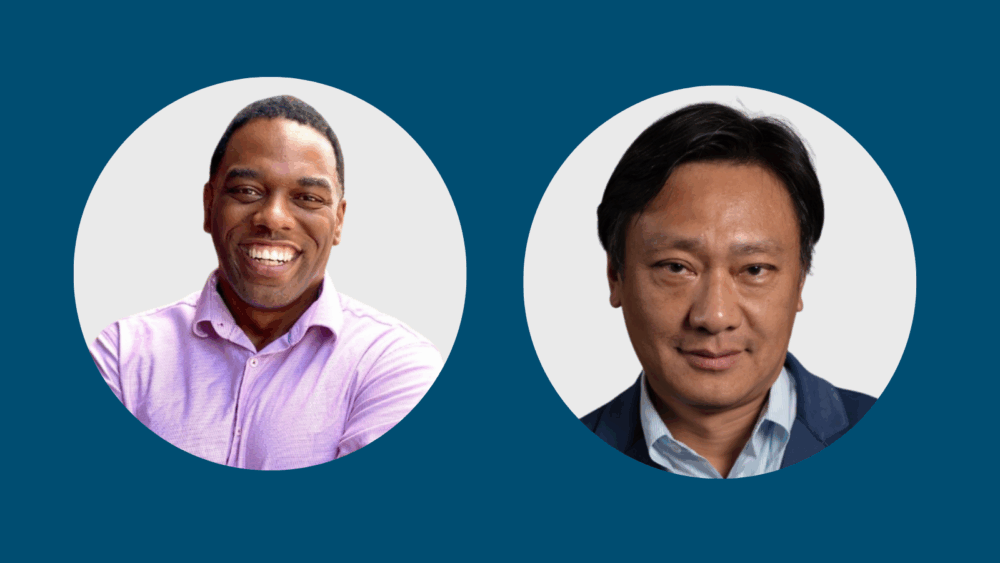

In 2024, Social Finance’s UP Fund invested in Upswing—a mission-driven company committed to supporting non-traditional college students in persisting through graduation. Social Finance’s VP of Impact Investments, Andrew Chen, sat down with Upswing’s CEO and Co-Founder, Melvin Hines, to reflect on the first year of our partnership, discuss his perspective on the evolving post-secondary education landscape, and hear his vision for Upswing’s future.

Andrew: Upswing focuses on serving non-traditional students—a segment often overlooked by edtech. Why did you choose to focus on this market?

Melvin: I co-founded Upswing over a decade ago to help non-traditional and historically underserved students similar to those I went to school with. I grew up in a small town in South Georgia, and attended a high school with limited resources, funding, or access. Because of that, I was 1 out of only 68 students to graduate out of a class of 250. When I went to the University of Georgia, I found that I was really unprepared for the entire college experience and was a league behind my classmates.

Thankfully, I graduated and wanted to ensure that similar students don’t have to go through the same challenges. Building a business focused on the most challenged students within an already challenging industry would turn a lot of people away. However, what we’ve found is that if we can help our partners solve their existential needs, they will be completely loyal to Upswing. Some of our partners have been with us since the first year we started Upswing.

What opportunities in the space are you most excited about over the next couple of years?

I think it’s hard to discuss the opportunities without first outlining the challenges. The 2025 enrollment cliff, which is the sharp decline in the number of college-aged students due to the drop in birth rates following the 2008 recession, has been on the minds of many higher education administrators for at least a decade, and now it’s here. There were 20 million college students when I first began Upswing in 2013, and now there are 16 million. This number will likely continue to shrink over the next 5 years. This isn’t just a challenge for schools competing to attract students—fewer college graduates will contribute to the risk of disruptive labor shortages across the country in the coming decades.

Compounding these challenges for colleges are cuts to various education funding sources impacting TRIO grants, work-study programs, Pell grants, and more.

But within these challenges, there are opportunities to do our work even better. Historically, non-traditional learners have been largely overlooked in favor of traditional, on-campus students. That has completely changed.

As a percentage of total enrollment, non-traditional student enrollment has skyrocketed. More non-traditional learners and historically marginalized students are enrolling and pursuing their degrees than ever before, and this is creating an urgent need for institutions to rethink how they provide support. These students often face unique challenges that traditional systems weren’t built to address. That’s where Upswing comes in. We’ve designed our services to offer holistic support, combining academic tutoring, mental health resources, basic needs support, advising, and a virtual assistant that connects students with the right help at the right time. By integrating these areas with existing institutional resources, we’re able to meet the needs of tomorrow’s students so they feel seen, supported, and equipped to succeed.

Upswing partnered with Social Finance in 2024 to establish a credit facility designed to support the company’s business and impact goals. Why did you choose to work with Social Finance?

We have been fortunate to be surrounded by investors who care about both returns and impact. So when we realized we would need a credit facility, we went to those investors and sought their advice. They overwhelmingly recommended Social Finance.

It didn’t take long for us to understand why. We ultimately chose to work with Social Finance because their mission aligns so closely with our own. At Upswing, we’re dedicated to breaking down barriers for non-traditional and historically marginalized students, ensuring they have the support they need to succeed in higher education. Social Finance brings that same commitment to driving measurable social impact, and their innovative approach to financing allows us to scale our services without losing sight of our mission. It’s rare to find a financial partner that not only provides capital, but also shares your values and vision for long-term impact. That alignment made Social Finance the perfect partner to help us expand our reach and deepen the outcomes we can deliver for students and institutions alike.

It’s rare to find a financial partner that not only provides capital, but also shares your values and vision for long-term impact. That alignment made Social Finance the perfect partner to help us expand our reach and deepen the outcomes we can deliver for students and institutions alike.Melvin Hines, CEO & Co-Founder, Upswing

How are the Upswing and Social Finance teams working together, and how do you hope the partnership will grow/expand?

Our teams are working hand-in-hand to better understand and predict the impact Upswing has on student success, with a particular focus on how our support influences students’ outcomes and life experiences after graduation. Together with Social Finance, we’re analyzing student engagement and outcome data to gain deeper insights into not only retention and persistence, but also how students feel about their career readiness and long-term employment opportunities. This collaboration is helping us move beyond traditional academic metrics to capture the full scope of how holistic support changes a student’s trajectory. Looking ahead, I see the partnership expanding to create even more sophisticated ways of measuring and demonstrating impact, giving institutions the confidence that investing in their students’ well-being directly translates into stronger academic and career outcomes.

Looking ahead, what’s your vision for Upswing’s role in reshaping higher education for non-traditional students?

Looking ahead, my vision for Upswing is to be at the forefront of reshaping higher education by making it a truly inclusive, wraparound student services experience for non-traditional students. As the nontraditional student population continues to increase, institutions need partners who can provide the holistic support these learners require to thrive academically, personally, and professionally. I see Upswing not only strengthening its role in higher education, but also expanding into workforce development programs, ensuring that students are prepared for meaningful careers after graduation. By bridging the gap between education and employment, we can help learners see a clear path from the classroom to the workforce, giving them the confidence and resources to succeed long term. Ultimately, I want Upswing to be recognized as the partner that helps students from all backgrounds to persist in college and achieve lasting economic mobility.

Learn more about Social Finance’s Workforce & Education Investments →

Related Insight

From Incentives to Impact: Boosting Earned Income Tax Credit Participation in New Jersey

In New Jersey, more than 200,000 low-income residents are missing out on the Earned Income Tax Credit—a powerful tool designed to boost income and reduce poverty. That’s an estimated $700 million in unclaimed benefits each…