What is the San Diego Pay It Forward Loan Program?

The San Diego Pay It Forward Loan Program is part of the ELEVATE Behavioral Health Workforce Fund, an initiative funded by the County of San Diego that aims to attract and retain more workers in the public behavioral health field. Through the San Diego Pay It Forward Loan Program, eligible students can access zero-interest loans to cover tuition, fees, and living expenses while they participate in select education and training programs at partner institutions.

Some of the key features of the San Diego Pay It Forward Loan Program include: 0% interest for all borrowers; a repayment deferment option for borrowers earning less than $50,000 annually; loan forgiveness after five years of service in public behavioral health; and retention-based loan credits for incumbent workers in public behavioral health (more details below).

Am I eligible for the San Diego Pay It Forward Loan Program?

To qualify for the San Diego Pay It Forward Loan Program, you must meet ALL of the following eligibility criteria at the time of application:

- Enrolled in an eligible education and training program at least half-time (see below);

- Authorized to work in the U.S. – U.S. citizen, U.S. permanent resident, DACA status, or TPS status with authorization to work in the U.S.;

- At least 18 years of age;

- Resident of California; and

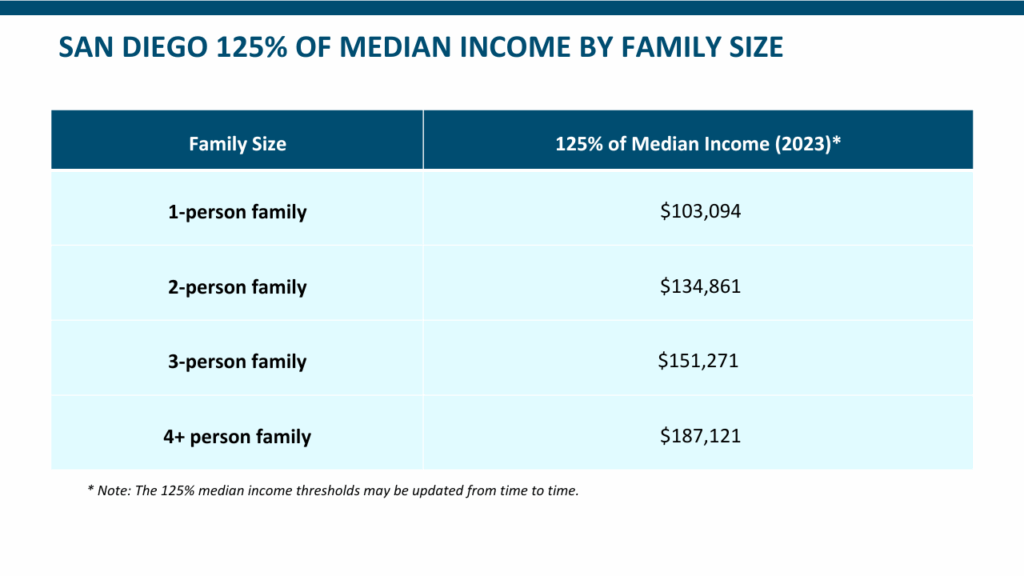

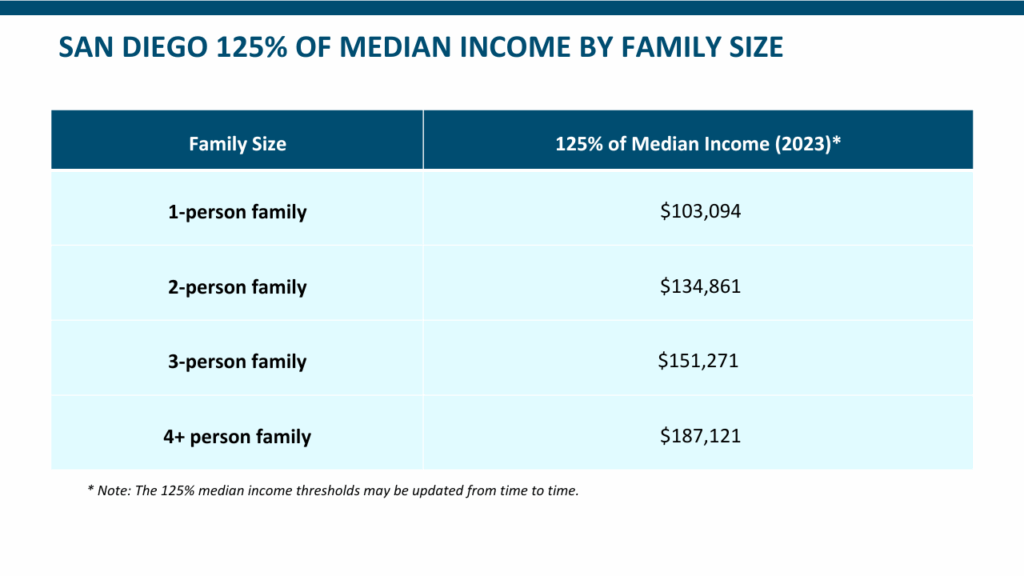

- Family income that is less than 125% of the median income in San Diego County based on your family size per the most recent U.S. Census Bureau data available (see below). For graduate students, family income for this eligibility criteria is defined as your individual gross income and your spouse’s gross income, if you are married.

Is there a credit score minimum to be eligible for the San Diego Pay It Forward Loan Program?

There is no minimum credit score or minimum credit history to be eligible for the San Diego Pay It Forward Loan Program. However, the loan originator, Funding U, will conduct a credit check and certain derogatory credit items such as being in an open bankruptcy proceeding or having accounts in collection in excess of $15,000 . The credit check may have an impact on your credit score.

What are the eligible education and training programs for the San Diego Pay It Forward Loan Program?

At this time, San Diego Pay It Forward Loan Program loans are available to eligible students enrolled in the following programs:

- San Diego State University

- Marriage & Family Therapy

- Early Childhood & Family Clinical Counseling

- Master of Social Work

- California State University San Marcos

This list will be updated as additional eligible education and training programs are confirmed.

How much can I borrow under the San Diego Pay It Forward Loan Program?

A Borrower may apply for a loan between $10,000 and $20,000 per academic year, up to a total maximum aggregate amount of $40,000 per borrower. When applying, please request a loan amount that will cover your outstanding financial need for the full academic year (i.e., fall and spring semesters). You cannot apply for multiple loans in the same academic year.

What is the Loan Forgiveness Benefit?

For a borrower who is approved for the Loan Forgiveness Benefit, the San Diego Pay It Forward Loan Program will forgive the borrower’s outstanding loan balance.

Note: Borrowers should consult a tax professional to understand the possible tax implications of receiving the Loan Forgiveness Benefit.

Who is eligible for the Loan Forgiveness Benefit?

To qualify for the Loan Forgiveness Benefit, a borrower must:

- Be in good standing on their San Diego Pay It Forward Loan Program loan; and

- Have completed at least five cumulative years of employment with an approved ELEVATE Behavioral Health Workforce Fund Eligible Employer (see list here) which included providing direct behavioral health services to patients with SMI, SUD and/or SED who are enrolled in or are eligible for Medi-Cal or Medicare. This does not have to be 5 consecutive years of employment, nor does it have to be with the same Eligible Employer.

Eligibility and approval for the Loan Forgiveness Benefit will be determined separately from the eligibility and approval process for the Incumbent Worker Retention Benefit.

How can I apply for the Loan Forgiveness Benefit?

To apply for the Loan Forgiveness Benefit, borrowers must submit the following documentation to the loan servicer ZuntaFi:

- A form signed by both the borrower and an authorized representative of the ELEVATE Behavioral Health Workforce Fund Eligible Employer, which includes the borrower’s dates of employment and an attestation that the borrower provided direct behavioral health services to patients who are enrolled in or are eligible for Medi-Cal or Medicare; and

- A W2 or IRS Form 1099 from each of the tax years listed on the attestation form that have been issued to date.

What is the Incumbent Worker Retention Benefit?

For borrowers who are approved for the Incumbent Worker Retention Benefit, the San Diego Pay It Forward Loan Program will apply a credit of up to $5,000 per year to the borrower’s outstanding loan balance.

A borrower’s annual Incumbent Worker Retention Benefit amount is calculated as the lesser of 20% of the borrower’s outstanding loan balance or $5,000.

Eligible borrowers may receive up to $25,000 in total retention benefit credits under the Incumbent Worker Retention Benefit (i.e., up to five retention benefit credits of $5,000 each).

Following each annual application of the Incumbent Worker Retention Benefit, the Borrower’s Program Loan will be re-amortized to reflect the updated loan balance.

Who is eligible for the Incumbent Worker Retention Benefit?

To qualify for the Incumbent Worker Retention Benefit, a borrower must:

- Have been employed by an approved ELEVATE Behavioral Health Workforce Fund Eligible Employer (see list here), in any role, for any duration of time in the two-year period prior to enrolling in the San Diego Pay It Forward Loan Program;

- Be employed by an approved ELEVATE Behavioral Health Workforce Fund Eligible Employer (see list here) after exiting from an education and training program partnering with the San Diego Pay It Forward Loan Program, in a role which includes providing direct behavioral health services to patients with SMI, SUD and/or SED who are enrolled in or are eligible for Medi-Cal or Medicare. Borrowers do not have to return to the same Eligible Employer they were previously employed with, nor are they required to remain with the same Eligible Employer after exiting their education and training program; and

- Be in good standing on their San Diego Pay It Forward Loan Program loan.

Eligibility and approval for the Incumbent Worker Retention Benefit will be determined separately from the eligibility and approval process for the Loan Forgiveness Benefit.

How can I apply for the Incumbent Worker Retention Benefit?

To apply for the Incumbent Worker Retention Benefit, borrowers must submit the following documentation to the loan servicer ZuntaFi:

- Either a paystub, W2, or IRS Form 1099 from an approved ELEVATE Behavioral Health Workforce Fund Eligible Employer (see list here) dated within the two years prior to enrollment in the San Diego Pay It Forward Loan Program;

- Either a completed employer attestation form confirming current employment, signed by both the borrower and an authorized representative of the approved ELEVATE Behavioral Health Workforce Fund Eligible Employer (see list here) OR

- A paystub dated within 30 days of the date of application for the Incumbent Worker Retention Benefit AND A completed self-attestation form that the borrower provides direct behavioral health services at least in part to patients with SMI, SUD and/or SED who are enrolled in or are eligible for Medi-Cal or Medicare.

Borrowers who do not have the documentation listed in the first bullet (e.g., due to working in an unpaid capacity) may instead submit a Pre-Training Program Employment Certification form.

A borrower may apply for their first Incumbent Worker Retention Benefit loan credit after exiting from an eligible education and training program related to the San Diego Pay It Forward Loan Program.

Borrowers may apply for up to five total loan credits via the Incumbent Worker Retention Benefit during their repayment period. However, each loan credit must be at least 12 months apart.

Is the Incumbent Worker Retention Benefit guaranteed to all borrowers who meet eligibility requirements?

the Incumbent Worker Retention Benefit is limited. While the benefit aims to support as many eligible applicants as possible, eligibility and funding are not guaranteed and the benefit will be distributed based on available funds, applicant eligibility, and other criteria. In some cases, applicants may not receive financial assistance even if they meet the eligibility requirements. The benefit amount and number of approved applications may vary each year, depending on the resources available.