Key Takeaway

Pay for Success is part of a growing movement debunking the myth that return and impact are incompatible; the investment structure creates a direct alignment between impact and financial performance.

In the last year, the question of impact measurement has risen to the forefront of the impact investment movement. Bridgespan and TPG created an innovative framework for calculating the impact of an investment. Similarly, the Stanford Social Innovation Review published a Playbook for impact measurement. Here at Social Finance, we discussed the Importance of Impact Measurement with practitioners at the 2018 SOCAP conference. We have no doubt that impact measurement will continue to be a defining question as the impact market grows.

Social Finance has built a unique niche in the impact investing ecosystem since our founding in 2011. In pioneering Pay for Success, we’ve developed a high-impact investment tool that we believe can guide the way as the field considers what true impact looks like and how to measure it.

Impact Investing: A Brief History

People were investing with an eye towards “doing good” long before the Rockefeller Foundation coined the term impact investing in 2007. The concept goes back to early religious congregations, like the Methodist Church, which taught its members not to partner with anyone who profited from alcohol, weapons, gambling or tobacco. This notion of “do no harm” led to the development of ethical or socially responsible investing (SRI) and continued to evolve throughout the nineteenth and twentieth centuries.

Then in 1984, Amy Domini co-authored the groundbreaking book Ethical Investing and launched a movement. Considered by many to be the mother of SRI, she created the first responsible stock index in 1990. Simultaneously, the corporate social responsibility (CSR) movement challenged Milton Friedman’s famous doctrine that a company’s social responsibility is to its shareholders. CSR led to greater accountability for the social and environmental repercussions in a company’s value chain.

Nearly three decades later, the impact investment landscape has grown tremendously with over $200 billion in assets under management dedicated to impact, a figure that some estimate could top $500 billion by 2020.

Across the Impact Spectrum

Traditional investment portfolios are defined by asset classes: public equity, debt, alternatives, etc. Rather than acting as a standalone asset class, impact is a theme that can be applied across them. Sir Ronald Cohen, a global leader of the impact investing movement and co-founder of Social Finance, categorizes impact as the third axis on the traditional risk-return grid. It’s a new dimension for investors to consider when making allocation decisions and it represents a spectrum of financial structures that prioritize return and impact in different ways.

One of the greatest challenges of incorporating impact into traditional asset classes has been capturing and reporting that impact. To meet a growing demand for information about measurable impact, organizations such as MSCI and Sustainalytics have developed ratings frameworks to quantify ESG characteristics in public stock portfolios. Additionally, many private investment funds create proprietary reports to disclose the social and environmental impact of their portfolio companies. These reports, however, are often limited to metrics such as the number of individuals served or the amount of carbon emissions avoided, rather than the tangible life change that companies generate. While insightful, they fall short of telling us what impact an investment has created for people and the planet.

The fundamental question remains: how do we best quantify the impact of an investment? Our work at Social Finance addresses this question by measuring long-term outcomes rather than outputs, directly tying financial returns to impact.

With each project that we develop, our goal is to identify measurable outcomes that represent a long-term, meaningful change in the life of an individual. Outcomes such as improved graduation rates, sustained housing for the homeless, or improved birth weights for babies in low-income communities are tied directly to project payments. Pay for Success aligns the stakeholders in a project around the achievement of these outcomes, so that an investor benefits only when the individual served does.

Impact Measurement Challenges

Creating a direct link between financial return and social impact is not without challenges.

- One of the biggest challenges in impact measurement comes with data collection and quality control. In order to accurately measure impact, we collaborate with our partners to gain access to critical information, including government data. Additionally, we work with our evaluators to design an appropriate measurement technique for quantifying outcomes.

- Another challenge is that a project’s value accrues differently to the various organizations involved. To address this nuance in Pay for Success, we explore the relevant evidence-base behind a proposed intervention. We focus on understanding which outcome metrics are applicable to the target population but also quantifiable and value-creating for project partners. Once all stakeholders have agreed upon the target metrics, we partner with a third party evaluator to maintain impartiality and accurately measure the outcomes of the program.

- Finally, given our focus on creating long-term impact, the measurement periods can be quite long. In many cases, the lasting outcomes may not be realized for several years, increasing the cost of capital. To address this challenge, our team may identify proxy outcomes, or those that have been shown to have a strong connection to the longer-term outcomes that our project pursue.

Evolution of Pay for Success

Pay for Success is part of a growing movement debunking the myth that return and impact are incompatible; the investment structure creates a direct alignment between impact and financial performance. The lack of correlation of returns to other asset classes also makes Pay for Success an interesting complement within a holistic impact portfolio. Returns are based on social outcomes that result directly from the service provider and the effectiveness of the intervention, rather than cyclical market or economic factors.

As we move toward Tipping Point 2020, the field of impact investing is reckoning with how we measure and demonstrate impact. Doing so will be critical for building a robust movement capable of realizing its full potential and making meaningful progress on our thorniest social challenges. Pay for Success is just one guidepost to help us as we set industry standards for the impact investment market.

Related Insight

A Landmark Moment for Pay for Success

Earlier this month, Congress passed bipartisan legislation that has significant implications for the Pay for Success (PFS) movement.

An Introduction to Pay For Success

Pay for Success is a set of innovative outcomes-based financing and funding tools that directly and measurably improve lives by driving resources toward results. Watch this video overview.

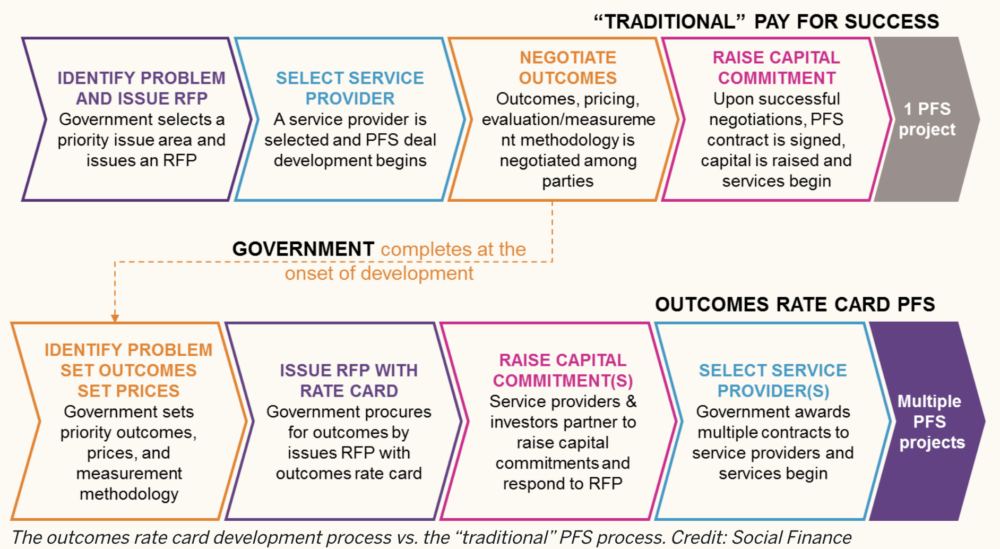

Innovations in Pay for Success: Outcomes Rate Cards

This blog on Living Cities details how Outcomes Rate Cards are developed and used to achieve high-quality outcomes.